Spain is attractive not only from the point of view of tourism. More and more often, this country is chosen as a place of permanent residence and business. The local legislation is open to foreign capital, and the Spanish laws provide a number of concessions for foreigners who decided to invest their capital in the economy of the country. They also offer a considerable number of bonuses: investing funds in opening an enterprise gives a foreigner the right to obtain a residence permit in Spain.

Today we will tell you how to open a business in Spain, what this procedure looks like and what you need to be prepared for.

Contents

- Features of business in Spain

- Market research and business planning

- Obtaining NIE and opening a bank account

- Choosing the form of enterprise

- Registering the enterprise

- Obtaining licenses and permits

- Interaction with tax authorities

- Hiring staff and other aspects of business

- Opening a business in Spain: pros and cons

Features of business in Spain

Spain has a rather loyal attitude to this issue. Any foreigner, along with the citizens of the country, has the right to open their own business in Spain. The process of opening a company and establishing its activity differs little from the procedure in the countries of the former USSR. There are their analogues of closed and open joint-stock companies – SL (Sociedad Limitada) and SA (Sociedad Anónima).

But there are also differences. The main one is that non-residents of the country, i.e. foreigners without a residence permit, do not have the right to be on the lists of employees of their or another company, receive an official salary and transfer money to the local pension fund. Non-residents can only have the status of a founder and receive profit in the form of dividends.

Foreigners who are residents of the country (including participants of the “Golden Visa” program) have the same rights as citizens of Spain.

The general requirements for a potential businessman are as follows:

- Adult age.

- The person must be in Spain on legal grounds (if he wants to be an employee of his company, he needs to obtain a residence permit with the right to work).

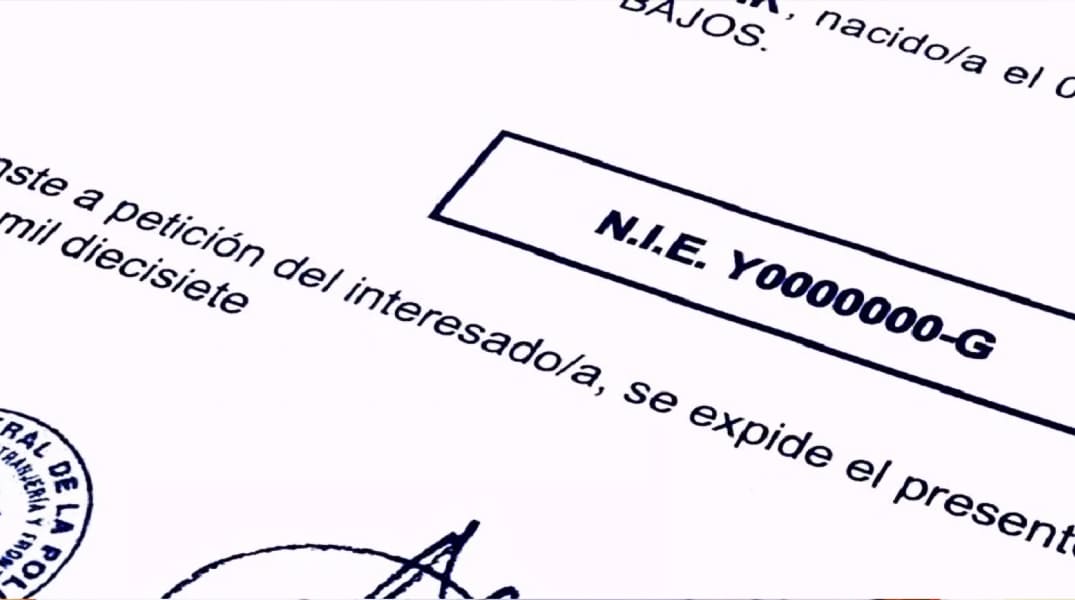

- He must have an identification number of the taxpayer (NIE).

- The person must provide evidence of ownership of the funds that are necessary for living and carrying out entrepreneurial activity.

To open a company in Spain, it is necessary to go through a certain procedure. We will tell you about all the stages in more detail.

Market research and business planning

The first and most important step is to study the Spanish market and develop a detailed business plan. In this case, a foreign entrepreneur needs to take into account the peculiarities of the local culture, consumer preferences and competitive environment.

The business plan should contain:

- The concept of business. It is important to describe in detail what your enterprise is, what services or goods the company offers, what segment of the market it will serve. The concept should clearly describe what exactly you offer and what your advantages are over competitors in your industry.

- Financial scheme. It is important to carefully think through the scheme of cash flows in the company. The business plan should contain the amount of the authorized capital, approximate calculations of the expected profit, all important expenses, etc.

- Financial investments. It is necessary to calculate the initial costs for creating and further promoting the business. For example, if you plan to take a loan in Spain, it is important to indicate where the guarantees for the repayment of the credit debt will be taken from.

- Internal structure of the enterprise. It is necessary to develop a structural organization of the company, a scheme of management, who will be the general director, founder and manager.

Obtaining NIE and opening a bank account

To start official activity in Spain, a foreign entrepreneur must obtain NIE (Número de Identificación de Extranjero) – an identification number of the taxpayer. This is necessary for registering a business and other official procedures. After that, you should open a bank account for the future business.

Choosing the form of enterprise

Spain offers various forms of enterprises, such as Sociedad Limitada (SL), Sociedad Anónima (SA), individual entrepreneurship (Autónomo), branches of international companies, cooperative (Sociedad Cooperativa), joint ownership of property (Comunidad de Bienes) and so on. Each of them has its own features in terms of taxation, obligations and regulation.

The most common form among foreigners is a closed joint-stock company (Sociedad Limitada). In this case, the founders are liable for debts in the amount of their contribution to the authorized capital. The owner of the enterprise cannot be the director – a person with a passport of Spain or one of the European Union countries is appointed to this position. The size of the authorized capital is 3100 euros.

With this form, you will have to pay the following taxes:

- Profit tax (IS) – from 15 to 25%. For newly created firms, the minimum rate applies for 2 years.

- VAT (IVA). The size is 4, 10 or 21% (depending on the type of product or service offered).

- Social security contribution for each employee of the company – 29.8% of the salary.

Registering the enterprise

After choosing the form of enterprise and developing a business plan, it is necessary to register the business in the Spanish trade register (Registro Mercantil) and take on all the legal obligations associated with the chosen form of enterprise.

Obtaining licenses and permits

Depending on the type of business, location and other factors, it may be necessary to obtain various licenses and permits: permission to use the trading area, licenses for restaurant or tourist business, permissions from local authorities, etc.

For example, in Madrid, you will need a city permit (licencia urbanistica) for construction, repair or demolition of buildings. This permit is required for all capital works that will be carried out inside and outside the building.

Interaction with tax authorities

Registration with the Spanish tax service (Agencia Tributaria) and obtaining NIF (Número de Identificación Fiscal) – a tax identification number, is mandatory for all entrepreneurs in Spain. It is also important to make sure that all necessary taxes are paid on time.

Hiring staff and other aspects of business

When hiring employees, it is also necessary to take into account compliance with labor legislation, conclusion of labor contracts and other aspects of personnel management.

Opening a business in Spain: pros and cons

Opening a company in Spain is a serious step, so it is important to weigh all the “pros” and “cons”.

Let’s start with the advantages of business in this country:

- You get the opportunity to open a company in a country that is among the TOP-10 most developed economic states of the European Union.

- It is not necessary to become a resident or citizen of the country to open your own business.

- Spanish banks are quite willing to lend to foreigners when opening companies.

- Opening a business allows you to count on getting a residence permit, and after some time you can apply for Spanish citizenship.

By the way, you can invest in Spanish real estate, which can also become a good and promising business. Over the past few years, the cost of housing in Spain has been growing exponentially, while Spanish real estate enjoys stable demand, which guarantees high profitability.

Among the disadvantages, perhaps, one can note the rather high level of taxes: VAT up to 21% and profit tax in the amount of 15-25%.

The Spanish government is loyal to foreigners who plan to open their own business here. The reason is simple – it is the opening of new jobs for local residents, because the problem of unemployment still persists.

The real estate agency “M2 Real Estate” offers a large selection of offers not only for buying housing, but also for commercial real estate. We will select an object for you with a good profitability and provide all the necessary consultations on opening a bank account in Spain, registering a company and other issues.